can you look up a tax exempt certificate

You can look up and verify a business tax-exempt number as well. According to the Internal Revenue Service you can download a copy of your determination letter using the Tax Exempt Organization Search TEOS tool at the IRSgov website.

![]()

Tax Exempt Registration At Menards

However obtaining a.

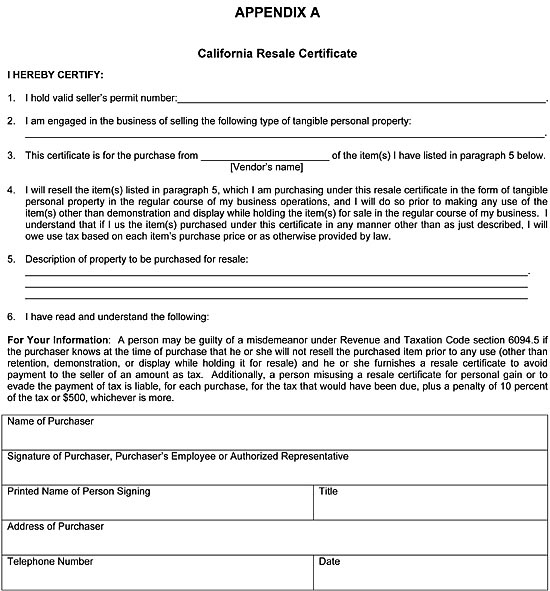

. When you are presented with a valid resale certificate you should allow the buyer to buy products tax free. Alabama Login required. The database is updated nightly.

How to Verify a Resale Certificate in Every State. Visit the website for the Department of Revenue or Comptroller for the state of the non-profit. Texas Enter available information for verification.

Your Kansas Tax Registration Number 000-0000000000-00. Once on the website scroll down to the Sales Tax License section and click on Verify a License or Exemption Certificate. Number should have 8 digits.

Fully complete the information in tabs 1 through 4 before providing your vendor with an electronic copy of the certificate or a printed and signed copy. Utah There is no online way to verify a resale certificate online. Search for a Business.

There are a number of. Complete the Type of Business Section. If you are unable to find a listing for an organization that you believe is exempt you may contact us by email or call us at 800-252-5555.

Arizona Enter the number here. Choose the option that enables you to search by the business name or the owners name. Another way to check the tax-exempt status of a company or organization is to call the IRS directly at 1-877-829-5500.

Sales and use tax certificates can be verified using the Tennessee Taxpayer Access Point TNTAP under Information and Inquiries. This verification does not relieve the vendor of the responsibility of maintaining a copy of the certificate on file. And if you sell to certificate-holding customers in one of these.

Tennessee Click Verify Sales and Use Tax Certificate. How do I get proof of tax-exempt status. You may use the electronic certificate S-211E to claim an exemption from Wisconsin state county baseball stadium local exposition and premier resort sales or use taxes.

Policy services and taxpayers programs unit url. If you need help with how to get a tax exempt certificate you can post your legal need on UpCounsels marketplace. How do I find my tax-exempt number.

Exemptions Certificates and Credits. The purchaser fills out the certificate and gives it to the seller. The required information is Taxpayer ID Type Taxpayer ID and Exempt Sales Account Number.

Florida Illinois Kansas Kentucky Maryland Nevada Pennsylvania South Dakota and Virginia. UpCounsel accepts only the top 5 percent of lawyers to its site. Arkansas Use either the resellers permit ID number or Streamlined Sales Tax number.

Visit the Appropriate Website. Without it correctly filled out the seller could end up owing sales taxes that should have been collected from the buyer in addition to penalties and interest. Lawyers on UpCounsel come from law schools such as Harvard Law and Yale Law and average 14 years of legal experience including work with or on behalf of companies like Google Menlo.

Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify. To be eligible for the exemption Florida law requires that political subdivisions obtain a sales tax Consumers Certificate of Exemption Form DR-14 from the Florida Department of Revenue. Steps for filling out the Michigan Sales and Use Tax Certificate Exemption Form 3372 Step 1 Begin by downloading the Michigan Resale Certificate Form 3372.

Information for farmers timber harvesters nursery operators and dealers from whom they buy to understand the scope of exemptions and reduced rates the purchases that remain taxable and how to effectively administer these tax provisions. Different purchasers may be granted exemptions under a states statutes. In most cases it is the responsibility of a buyer to fill out the tax-exempt certificate at the point of purchase.

Then choose the exemption type from the pull-down and then enter the 9 digit ID number. Purchasers requesting sales tax exemption on the basis of diplomatic or consular status must circle number 20 for Other and write in Diplomatic Mission for both Personal and Mission-related expenses. Click the Search for a Business Link.

Find the website for your states department of revenue and click on the option that allows you to look up a business. The United States government or any of its federal agencies is not required to obtain a Florida Consumers Certificate of Exemption. If you dont care to search for your letter online you can also submit IRS Form 4506-A via fax or email to the IRS.

Sales tax exemption certificates enable a purchaser to make tax-free purchases that would normally be subject to sales tax. The seller keeps the certificate and may then sell property or services to the purchaser without charging sales tax. If you hold a tax exemption certificate in one of these states make sure you renew as required to avoid possible penalties.

Click on the Search for a Business link. Can you look up a tax exempt certificate. The identifying information for your business is part of the public record and it is available to anyone who wants to find it.

Exemptions are based on the customer making the purchase and always require documentation. There are different types of exempt organizations. Choose search for charities and go to search now.

From there click the Start Over button Business Verify an Exemption Certificate. The Department of Revenue recently redesigned the certificates the Department issues. Certificates last for five years in at least 9 states.

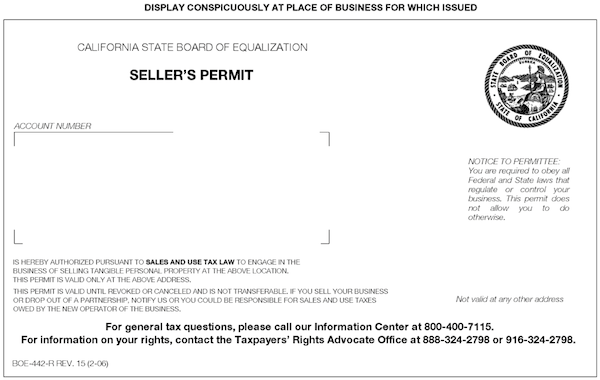

Click on the search for a business link. Clicking on the Verify a License or Exemption Certificate option under the sales tax option of the Colorado websites lets a user verify a resale certificate. An exemption certificate is the form presented by an exempt organization or individual to the seller when making a tax-exempt purchase.

Sellers Permit Vs Resale Certificate Mcclellan Davis Llc

Printable California Sales Tax Exemption Certificates

Tax Exempt Meaning Examples Organizations How It Works

How To Register For A Tax Exempt Id The Home Depot Pro

Sellers Permit Vs Resale Certificate Mcclellan Davis Llc

Tax Clearance Certificates Department Of Taxation

/ScreenShot2021-02-12at5.09.36PM-b75ba9a9a4d64190a7e9d8297218886a.png)

Form 990 Return Of Organization Exempt From Income Tax Definition

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

Resale Certificate Request Letter Template 11 Templates Example

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

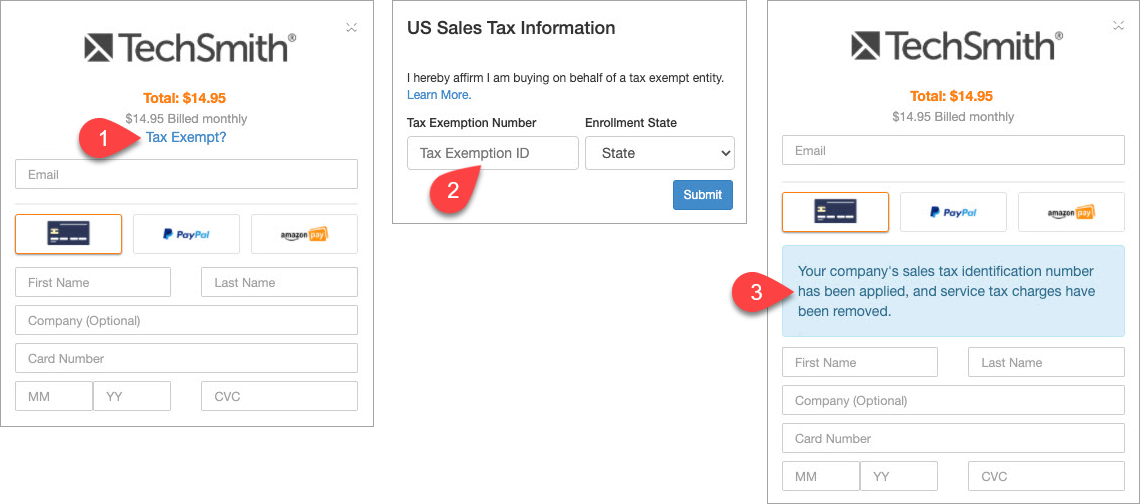

Do I Have To Pay Sales Tax What If I Am Tax Exempt Techsmith Support

How Do I Know If I Am Exempt From Federal Withholding

What Do Tax Exemption And W9 Forms Look Like Groupraise Com

State W 4 Form Detailed Withholding Forms By State Chart